An Unbiased View of Baron Tax & Accounting

An Unbiased View of Baron Tax & Accounting

Blog Article

Our Baron Tax & Accounting Statements

Table of ContentsBaron Tax & Accounting Things To Know Before You Get ThisBaron Tax & Accounting for BeginnersBaron Tax & Accounting Fundamentals ExplainedThe Ultimate Guide To Baron Tax & AccountingBaron Tax & Accounting Fundamentals Explained

And also, accountants are anticipated to have a suitable understanding of maths and have some experience in an administrative role. To come to be an accountant, you must contend the very least a bachelor's level or, for a greater degree of authority and competence, you can come to be a public accountant. Accountants must also fulfill the stringent demands of the bookkeeping code of practice.

The minimal credentials for the certified public accountant and ICAA is a bachelor's level in audit. This is a beginning point for refresher course. This guarantees Australian entrepreneur obtain the ideal feasible economic advice and management possible. Throughout this blog site, we have actually highlighted the big distinctions in between bookkeepers and accounting professionals, from training, to functions within your organization.

The Best Guide To Baron Tax & Accounting

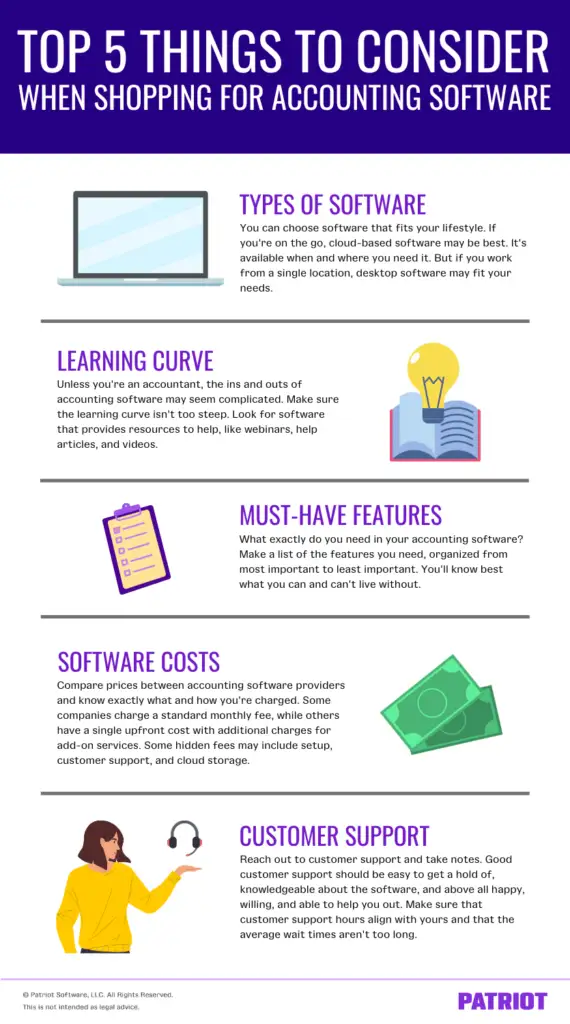

Bookkeeping firms do greater than simply accounting. The services they provide can make best use of earnings and sustain your funds. Services and individuals should take into consideration accountants a vital element of monetary planning. No accountancy company supplies every solution, so ensure your experts are best matched to your details demands (maximise tax refund Australia). Recognizing where to start is the initial obstacle

Accountants likewise can suggest clients on making tax obligation legislation help them. All taxpayers have the right to depiction, according to the IRS. Accounting firms can assist companies represent their interests with appointment for filing procedures, info demands, and audits. Many companies do not work alone to attain these solutions. They work alongside attorneys, economic coordinators, and insurance coverage professionals to create a strategy to lower taxi settlements and avoid expensive errors.

(https://www.40billion.com/profile/997031088)

Accounting professionals exist to determine and upgrade the set quantity of cash every employee gets regularly. Keep in mind that vacations and illness affect pay-roll, so it's a component of the business that you have to constantly upgrade. Retired life is likewise a significant aspect of payroll monitoring, specifically considered that not every staff member will certainly intend to be registered or be qualified for your business's retirement matching.

Some Known Questions About Baron Tax & Accounting.

Some loan providers and capitalists call for crucial, strategic decisions between business and investors complying with the conference. Accounting professionals can additionally be existing below to assist in the decision-making procedure. Preparation involves releasing the income, capital, and equity statements to assess your present monetary standing and problem. It's very easy to see just how intricate accounting can be by the variety of abilities and tasks required in the role.

Tiny services frequently deal with unique monetary obstacles, which is where accountants can supply important assistance. Accounting professionals offer a variety of solutions that help organizations stay on top of their funds and make notified choices. individual tax refund Australia.

Accounting professionals make certain that employees are paid accurately and on time. They determine payroll taxes, handle withholdings, and make certain compliance with governmental policies. Handling incomes Managing tax filings and settlements Tracking employee advantages and reductions Preparing payroll records Proper click here now payroll monitoring prevents concerns such as late settlements, wrong tax filings, and non-compliance with labor laws.

The Basic Principles Of Baron Tax & Accounting

This step decreases the danger of errors and possible penalties. Local business proprietors can rely upon their accountants to take care of intricate tax obligation codes and laws, making the filing procedure smoother and much more reliable. Tax planning is one more vital solution offered by accounting professionals. Effective tax obligation planning includes planning throughout the year to reduce tax obligation liabilities.

These solutions typically concentrate on business valuation, budgeting and forecasting, and capital management. Accounting professionals assist local business in establishing the well worth of the company. They evaluate possessions, responsibilities, earnings, and market conditions. Methods like,, and are utilized. Precise evaluation assists with selling the company, protecting lendings, or attracting financiers.

Explain the procedure and solution inquiries. Deal with any kind of inconsistencies in documents. Overview local business owner on finest methods. Audit support aids companies experience audits smoothly and efficiently. It decreases tension and mistakes, ensuring that companies satisfy all required regulations. Legal conformity includes adhering to regulations and guidelines connected to business procedures.

By establishing realistic financial targets, organizations can assign sources successfully. Accounting professionals guide in the application of these strategies to guarantee they align with business's vision. They often evaluate strategies to adapt to transforming market conditions or service growth. Danger administration involves determining, assessing, and mitigating dangers that can impact a business.

Getting My Baron Tax & Accounting To Work

They assist in setting up interior controls to avoid fraudulence and mistakes. In addition, accounting professionals suggest on conformity with lawful and governing needs. They ensure that businesses follow tax obligation regulations and sector regulations to stay clear of charges. Accountants also recommend insurance policies that offer protection versus prospective dangers, making sure the organization is secured against unforeseen occasions.

These tools assist small companies maintain accurate records and enhance procedures. It helps with invoicing, payroll, and tax obligation preparation. It uses numerous attributes at no cost and is appropriate for start-ups and small businesses.

Report this page